Complete protection insurance might additionally include obligation coverage. The option to complete insurance coverage is generally responsibility coverage only, which supplies much less security. Learn Extra From An Experienced Attorney Eventually, the principles of complete tort insurance coverage and full protection need to be thought about separately. We can assist you assess your choices (vehicle).

With costs on the rise once more, full-coverage automobile insurance coverage can shield your car and also provide coverage for mishaps that result in injuries or residential or commercial property damages. What is complete insurance coverage automobile insurance policy, precisely?

This is what lending institutions mean when they call for complete protection for an automobile lending. Car responsibility insurance coverage, Medical coverage, Uninsured/underinsured vehicle driver protection, Full protection cars and truck insurance policy broadens a policy with these needed coverages to consist of defense against physical damages, as well - vehicle. Accident insurance policy, Comprehensive insurance coverage, The physical damages coverage on your plan enables your plan to assist spend for damage triggered to your automobile when nobody else is at fault.

credit score cheap car auto prices

credit score cheap car auto prices

Without collision insurance coverage, you pay for the repair work on your own. With accident insurance coverage, the insurer can spend for repair services that surpass your deductible - laws. By comparison, if a neighbor inadvertently backed right into your Buick parked in the street, your neighbor's liability insurance need to spend for repair services to your automobile. While crash protection targets damage in which no one else is at mistake, there are situations where you can utilize your collision insurance policy even if one more driver caused the damages.

The Have a peek at this website 25-Second Trick For When To Drop Full Coverage On A Car - Quotewizard

cheapest car insurance cheapest auto insurance money suvs

cheapest car insurance cheapest auto insurance money suvs

Automobile obligation insurance coverage, Responsibility insurance policy on an individual car policy targets personal auto-related threats (insurance). Your responsibility insurance coverage spends for injuries created to others and also unexpected damages caused to the residential property of others. For instance, if you misjudge the range when revoking a garage and also struck a parked vehicle, you're liable for the damage to the parked auto (insurance affordable).

cheapest car auto insurance risks vehicle

cheapest car auto insurance risks vehicle

If you're at mistake in a mishap resulting in an injury to someone else, the physical injury liability insurance policy on your automobile policy can help pay for the medical requirements of the hurt person. Each state sets its own minimum coverage limitations for called for responsibility insurance policy, yet you have the choice to choose higher insurance coverage limitations for far better protection.

states need , while even more than a dozen call for drivers to bring UIM.See all 7 photos, Crash Insurance coverage, As part of complete insurance coverage vehicle insurance policy, crash insurance pays for damage caused by call with one more automobile or a dealt with item - laws. Damage claims due to car rollovers are additionally covered by crash insurance coverage, as are damage insurance claims due to pits. insurance companies.

Covered dangers consist of theft, vandalism, dropping things, fire, floods, and damage because of animals (prices). Glass damage additionally falls under comp insurance coverage if the damage was not triggered by a collision. Other Protection Options, The majority of insurance policy policies offer extra insurance coverages and choices, also, several of which pivot upon existing coverages - liability.

Full Coverage Auto Insurance: When Is It A Good Idea? (2022) for Dummies

Also when not called for, complete protection can be a smart investment. Let's state you acquire a new cars and truck for $40,000 with a five-year car loan - insure.

Comprehensive protection is normally optional, however you might be needed to carry it if your car is funded by a lender or rented. To read more concerning these kinds of coverage, along with medical payments protection (Medication, Pay), personal injury protection insurance policy (PIP), and also uninsured/underinsured motorist coverage (UM/UIM), inspect out our full short article on the conventional kinds of vehicle insurance.

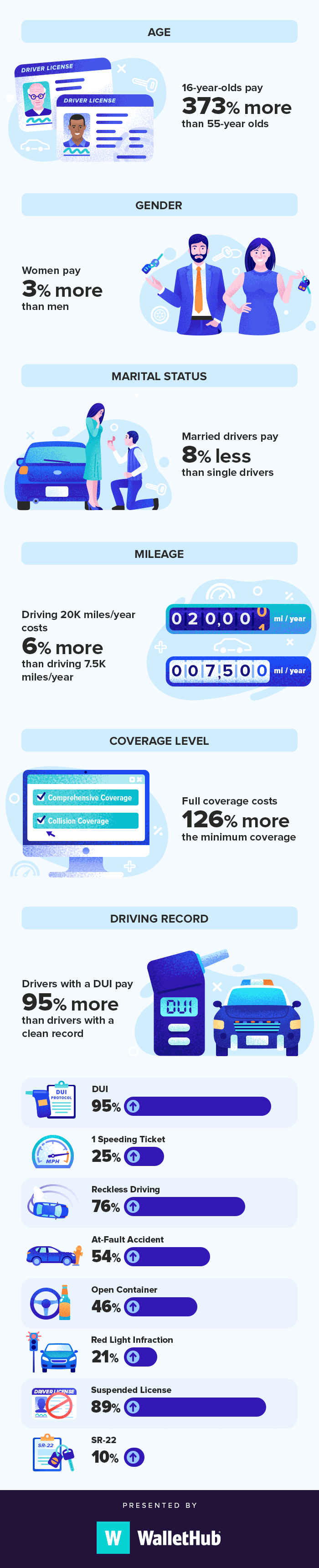

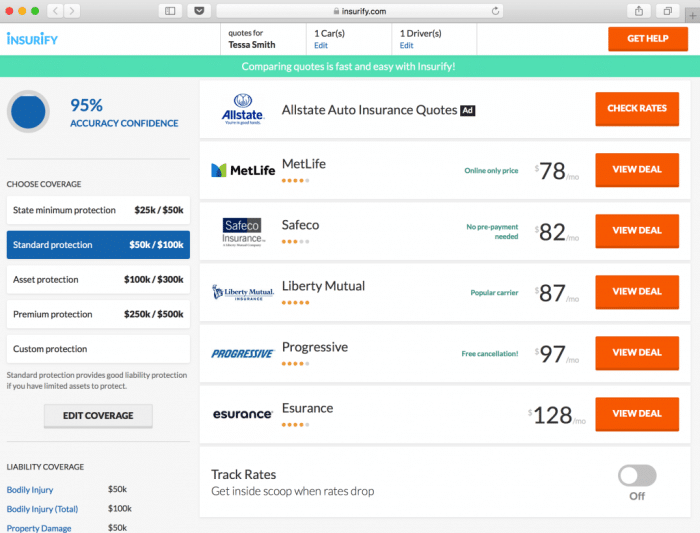

That being stated, the average cost of complete coverage auto insurance depends on several elements: Your insurance coverage company Your lorry Your deductible, with greater deductibles leading to lower prices Your driving record as well as age Your state Car insurance policy prices are not standard, so each carrier is free to establish its very own rates. laws.

affordable car insurance money insure cheaper

affordable car insurance money insure cheaper

But if you're a brand-new vehicle driver who has no background to back them up, as well as you're residing in Texas, the state with the greatest number of crashes annually, your insurer is mosting likely to require to charge you much more. Full Coverage Auto Insurance Coverage Vs. Minimum Insurance Coverage Insurance policy In some methods, the easiest method to understand the benefits of complete protection cars and truck insurance policy is to contrast it to minimum insurance coverage insurance policy (accident).

Indicators on What Does Full Coverage Car Insurance Cover? - Findlaw You Need To Know

That suggests you're covered versus any type of injury or damage you might trigger to various other individuals and also their home, however when it comes to your own injuries or damages to your automobile, you're out of luck. If you enter into an accident that completes your automobile however just have responsibility insurance coverage, you're going to need to acquire a brand-new automobile with no assistance from your insurance coverage firm. cheap.

Clearly, getting just the minimum insurance coverage leaves you at danger for some very unpleasant financial shocks. Due to the fact that of these huge threats, we suggest that drivers take out full protection car policies to guarantee them versus abrupt big costs.

automobile car cheaper affordable car insurance

automobile car cheaper affordable car insurance

What is Full Protection? Full protection also consists of the state-mandated minimum obligation coverage.

This is the amount that you must pay out-of-pocket (not covered by your policy) in case of a crash - accident. Typically, a greater deductible suggests a lower price (or cost per month) for your insurance plan, so if you're trying to find extensive coverage however want a lower rate, you can boost your insurance deductible (credit score).

The Best Strategy To Use For What You Need To Know - Minnesota Department Of Public Safety

Full insurance coverage pays a quantity as much as the real cash worth of your car to either repair it or replace it (if it is an overall loss). If your vehicle is worth $5,000 at the time of the crash, you are covered up to $5,000. If the damages exceeds $5,000, the insurance policy company declares the car a failure and pays you $5,000 to assist you replace it.

Here's what each of these sorts of insurance coverage consists of:: This plan spends for the expense of damages to your car after an accident. It consists of accidents with various other lorries as well as roadway risks. Crash insurance coverage does not include mishaps involving animals.: Comprehensive insurance coverage spends for problems to your car that are caused by an animal, all-natural catastrophe, theft or vandalism.